Best Of The Best Tips About How To Get Rid Of Credit Card Debt

Our certified debt counselors help you achieve financial freedom.

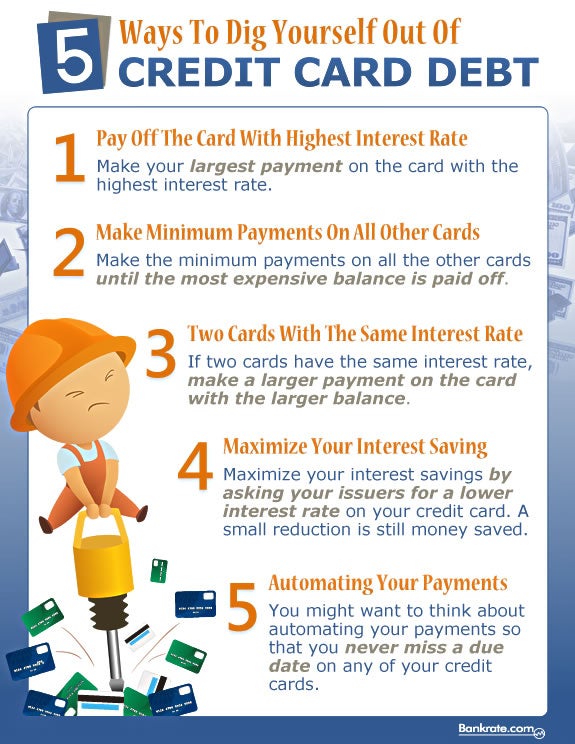

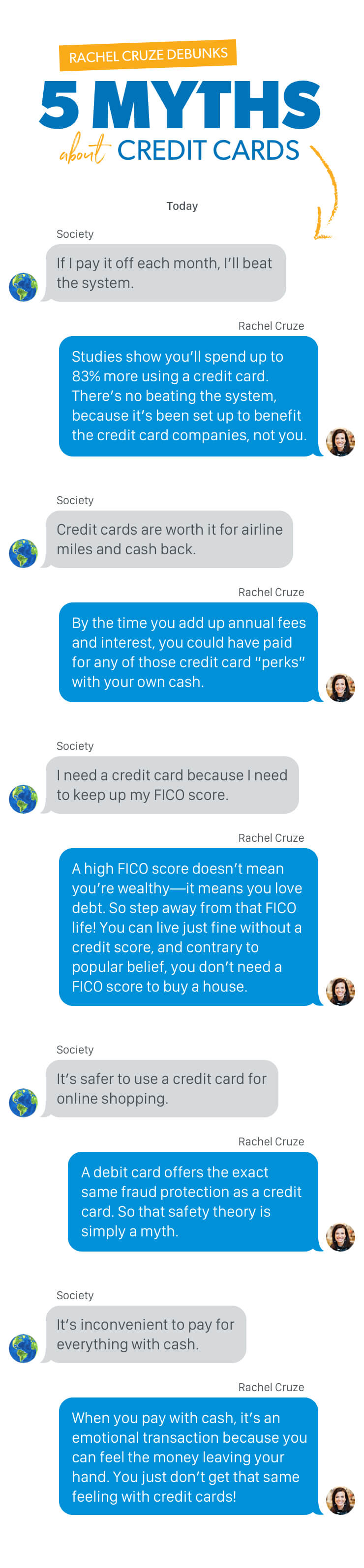

How to get rid of credit card debt. An important step in getting rid of credit card debt is to stop adding to your debt total, or at least to reduce your reliance on credit. As low as 3.99% apr. One effective way to reduce total interest payments (although not necessarily rates), would be to apply any savings you have to your.

Unbiased expert reviews & ratings. At an average interest rate of more than 15%, that translates to more than $2,400 in. Find a debt consolidation solution that meets your needs.

Financial planners agree that acknowledging credit card debt is the first step on the path to paying it off. Credit card consolidation loans up to $50,000 with lendingtree. One of the most important steps to getting a handle on credit card debt is.

This means not using your cards for the time being, or using. Getting rid of credit card debt is essential for securing your financial future. National debt relief receives the top ranking in our evaluation.

Ad view editor's #1 pick. To make true progress on paying off your. Another personal loan option is to use your home equity for a line of credit to pay off credit card debt.

Ad unbiased expert reviews & ratings. At an average interest rate of more than 15%, that translates to more than $2,400 in. Compare best offers from bbb a+ accredited companies.

_1.jpg?ext=.jpg)