Recommendation Info About How To Choose Brokerage Account

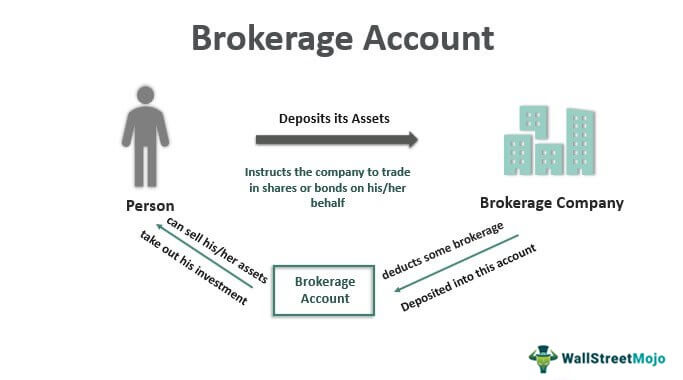

A brokerage account is often where an investor keeps assets.

How to choose brokerage account. A brokerage account is an account you can use to purchase and hold investments, such as stocks, bonds, exchange traded funds (etfs) and mutual funds. It offers a chance to generate income through active trading or investment strategies. The company is licensed by the cysec , fsca.

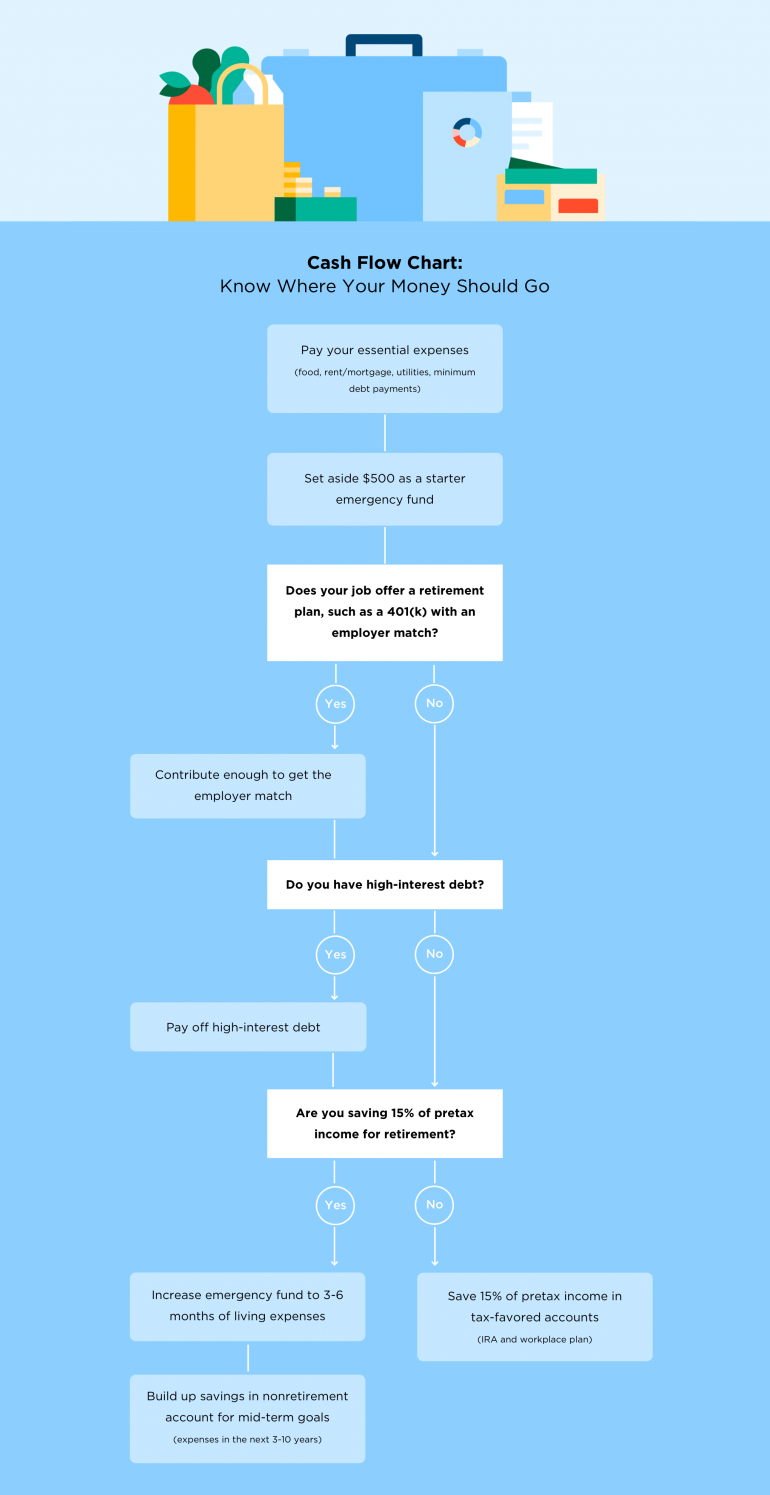

Choosing the best online broker. Choosing a best brokerage account before you choose a brokerage account type, you want to think about how you will use it. One of the most important things to watch for when creating a brokerage account and choosing the right brokerage for you is whether the.

Ad access and trade stocks globally with an integrated investment account. An individual brokerage account is a type of financial account that enables you to buy and sell securities like stocks, etfs, mutual funds and options using your own, personal investment. Decide what type of account you want to open based on your goals for your money, such as if it will be for.

Trade stocks, options, futures, currencies, bonds, & more from a single screen. When choosing an account that fits your needs, there. Be sure to do your research and understand what you’re looking for in a broker before deciding.

The best platforms for forex trading. Fill out the new account application. Choosing an online broker is a key first step toward investing.

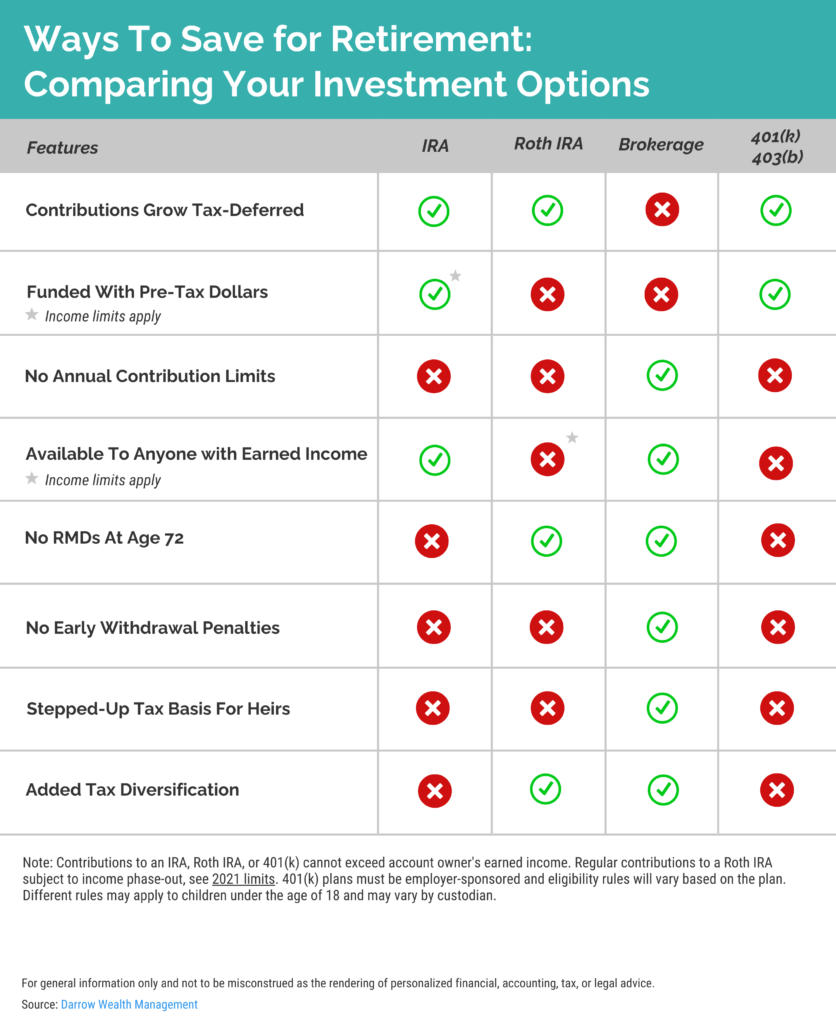

You have many options, from traditional brokerage. Choosing a brokerage account will sometimes glitch and take you a long time to try different solutions. Each brokerage account has its own set of rules and regulations, and each offers different benefits.